Italian Real Estate Market Overview

Inflation, interest rates, and decreased purchasing power are terms we’ve become familiar with over the past few years. But how is this affecting the real estate market in Italy? Is it still worth buying property or investing in real estate?

Real Estate Transactions

The number of real estate transactions is a key metric to understand the health of the real estate market. This indicator provides several crucial insights:

- Supply and Demand: The volume of transactions reflects market demand and supply. A high number of transactions indicates strong demand and an active market, while a low number may suggest weak demand or insufficient supply.

- Economic Cycle: Real estate transactions are closely tied to economic cycles. During periods of economic growth, transactions tend to increase due to higher income availability and consumer confidence. Conversely, in times of recession, the number of transactions may decline.

- Property Prices: An increase in the number of transactions can often lead to higher property prices due to increased competition among buyers. Conversely, a decrease in transactions can exert downward pressure on prices.

- Market Sentiment: Trends in transactions can provide insights into investor and consumer sentiment. An increase in transactions can indicate optimism, while a decline may signal economic concerns or future uncertainties.

- Affordability Indicators: Changes in transaction volumes can be used to calculate affordability indices, helping to assess households’ ability to purchase homes based on their income and property costs.

Typically, the movement in the number of transactions precedes price trends, meaning transactions usually decrease before prices follow suit.

General Trends

In 2023, the Italian real estate market experienced a significant decline in transactions, interrupting the growth trend seen in previous years. The reduction was more pronounced in Central and North-Eastern Italy, with decreases of 13.1% and 11.7%, respectively. Overall, 709,591 homes were sold, a 9.7% drop compared to 2022.

House Price Analysis in Italy

Despite the decline in transactions, house prices continued to rise, albeit at a slower pace than in previous years. In 2023, house prices increased by just over 1%, a modest growth compared to the 4% recorded in 2022. This moderate price increase can be attributed to reduced demand and higher mortgage interest rates, preventing prices from rising further. It’s worth noting that prices tend to be slow to adjust, with sellers taking years to adapt to decreased buyer demand.

Declining Property Demand

According to Coach Immobiliare, the demand for properties, as measured by visits to major real estate websites, dropped by 12.25%.

This means that there are less buyers in the market, will the prices drop for this low demand?

Mortgage Market in Italy

Mortgages played a significant role in the decline of the real estate market in 2023. Rising interest rates and reduced borrowing capacity prevented many from purchasing homes. This dynamic affected lower-income groups and young first-time buyers the most, for whom mortgages are essential for buying a home.

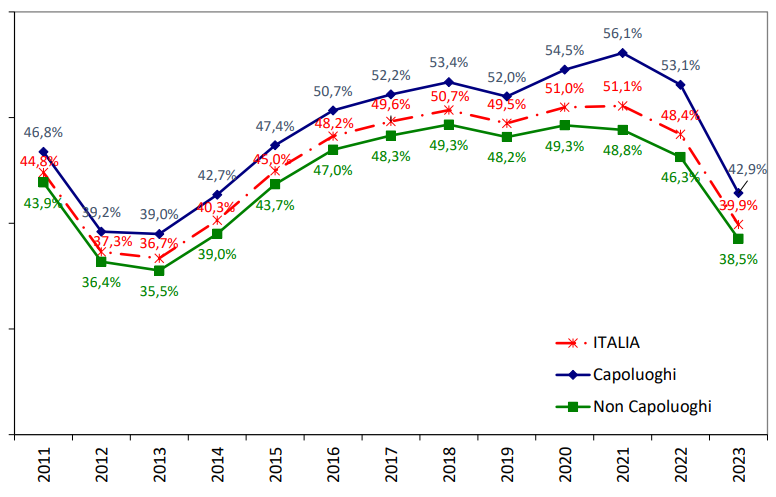

Fewer Mortgages

In 2023, 44.5% of home purchases in major Italian cities were financed through mortgages, a decrease of over 11 percentage points compared to 2022. The highest percentage of mortgage-financed purchases was in Rome (over 51%), while the lowest was in Palermo and Naples (around 37%). All major cities saw a decline in mortgage-financed transactions, with Bologna, Florence, and Rome experiencing drops exceeding 30%, and Naples and Palermo over 20%. In the provinces of major cities, the decline was 24.2%.

Reduced Mortgage Capital

The total capital disbursed for mortgages in the eight major Italian cities was about 7.8 billion euros, a reduction of over 4 billion compared to 2022 (-35%). In the provinces of major cities, the capital disbursed was about 6.9 billion euros (-28.9%). Rome and Milan accounted for a significant share of the financing, with approximately 3 billion euros in Rome and 2.4 billion euros in Milan, both down 35%. Milan had the highest average mortgage amount at around 225,000 euros per home, 16,000 euros less than in 2022. The average mortgage granted was 170,000 euros, about 14,000 euros less than in 2022, indicating a reduced borrowing capacity among buyers.

Interest Rates

In 2023, the average initial mortgage rate in major cities was 4.43%, with Naples recording the highest rate (5.58%), an increase of 2.34 percentage points compared to 2022. Bologna had the lowest rate, below 4%. The average initial monthly payment was about 920 euros, an 11.2% increase from 2022, with the highest payment in Milan (almost 1,200 euros) and the lowest in Genoa (about 550 euros).

Regional Data

The Italian real estate market continues to show strong regional differences. Northern Italy, particularly the North-West and North-East, experienced the largest transaction declines. Central Italy saw a significant drop, while the South and Islands showed greater resilience with less pronounced declines.

Major Cities

Major cities such as Rome and Milan saw significant transaction reductions. Milan experienced a 10.2% decline, while Rome saw an 11.2% decline, demonstrating that even the most dynamic real estate markets are not immune to negative trends.

Affordability Index

The affordability index measures the ability of families to purchase a home by comparing available income with housing costs and mortgage interest rates.

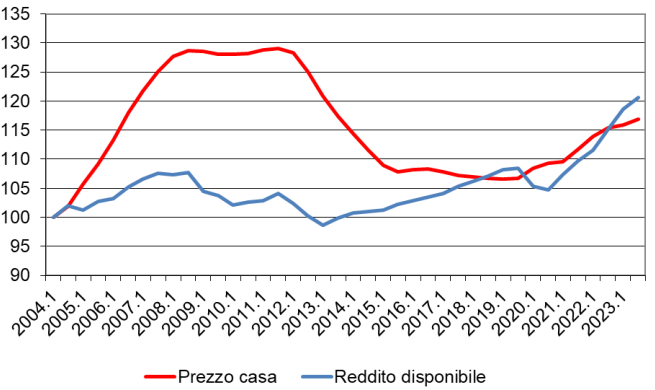

The analysis of Italian households’ ability to purchase a home is based on the relationship between house prices and disposable income. From 2004 to 2023, house prices and household income showed different dynamics. In 2023, both house prices and household income increased, but disposable income grew more (+4.7%) compared to house prices (+1.7%). The average income rose from 45,790 euros in 2022 to 49,464 euros in 2023.

Predictions for 2024

Projections indicate that in the first quarter of 2024, annual income should grow by another 1% compared to the end of 2023, while house prices are expected to remain stable in the first quarter of 2024.

Income Required to Buy a Home

In 2023, the number of years of income required to buy a home fell to 3 years and 42 days, the lowest value since 2010, indicating an improvement in housing affordability compared to the past.

Interest Rates on Mortgages

The average long-term mortgage rate in 2023 was 4.05%, an increase of 1.6 percentage points compared to 2022. However, starting from December 2023, mortgage rates began to decrease, reaching 3.56% in March 2024.

Affordability Index Dynamics

In 2023, the affordability index fell to 11.6%, nearly 2 percentage points less than in 2022, mainly due to rising interest rates. However, conditions for home purchase access remain favorable compared to historical levels. The trends in the first months of 2024 indicate a possible continuous improvement due to stable house prices and reduced mortgage rates.

Breakdown of Affordability Index Variation

The affordability index variation is influenced by three main components:

- Price Effect: The contribution of house prices relative to disposable income.

- Rate Effect: The contribution of mortgage interest rates.

- Residual Effect: The combination of price and interest rate changes.

In 2023, the rise in interest rates had a greater negative impact on the affordability index, while the relative house price contributed positively, albeit to a lesser extent.

Despite the reduction in the affordability index in 2023, conditions for home purchase access are still better than pre-financial crisis levels. Early 2024 trends suggest a possible continued improvement due to stable house prices and reduced mortgage rates.

Conclusion: It is worth investing in the italian real estate market?

The Italian residential real estate market faced a challenging year in 2023, with a significant decline in transactions and rising mortgage interest rates. Despite these challenges, the market showed resilience, with house prices remaining relatively stable. Regional differences remain pronounced, with some areas showing more dynamism than others. Prospects for 2024 indicate possible market stabilization, with a moderate recovery in transactions and reduced mortgage interest rates. However, the overall economic trend and fiscal and monetary policies will be crucial for the future of the Italian real estate market.