This is a real house in Italy. The asking price? One euro.

Sounds too good to be true, right?

Well, it is. Sort of.

These houses – scattered across dozens of Italian towns from Sicily to Tuscany – have become viral sensations. “Buy your dream Italian villa for the price of a coffee!” the headlines scream. Influencers post romanticized videos of crumbling stone walls and overgrown gardens, promising you can own a piece of la dolce vita for pocket change.

But here’s what those videos don’t tell you: by the time you’re done with that one-euro house, you could easily be €50,000 to €150,000 in the hole. And that’s if everything goes smoothly.

I’m Jacopo Tartaglia, founder of Valente Italian Properties. I’ve helped dozens of international buyers navigate the Italian real estate market – and I’ve seen enough one-euro house disasters to fill a horror movie. In this video, I’m going to explain exactly why Italy is giving away these houses, what the real costs are, who should actually consider buying one, and why most people – especially foreign investors – should probably stay far away.

I’ll show you the exact budget breakdown of what turning a one-euro house into a livable home actually costs, with real numbers from actual projects.

Let’s get started.

CHAPTER 1: Why Is Italy Giving Away Houses?

The Demographic Crisis Behind the Headlines

So why would any town give away property for the price of a candy bar?

Simple: Italy is dying. Not in a poetic, romantic sense. Literally dying – demographically speaking.

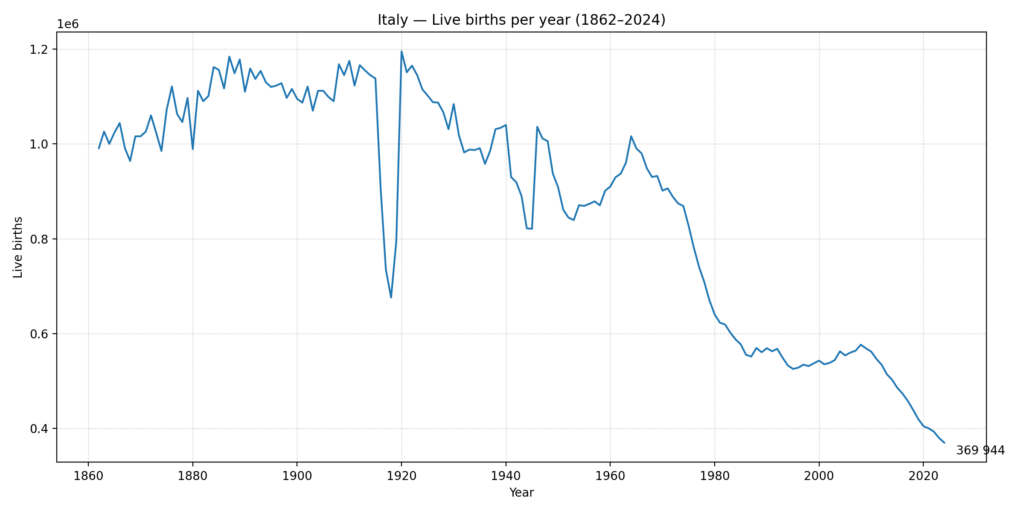

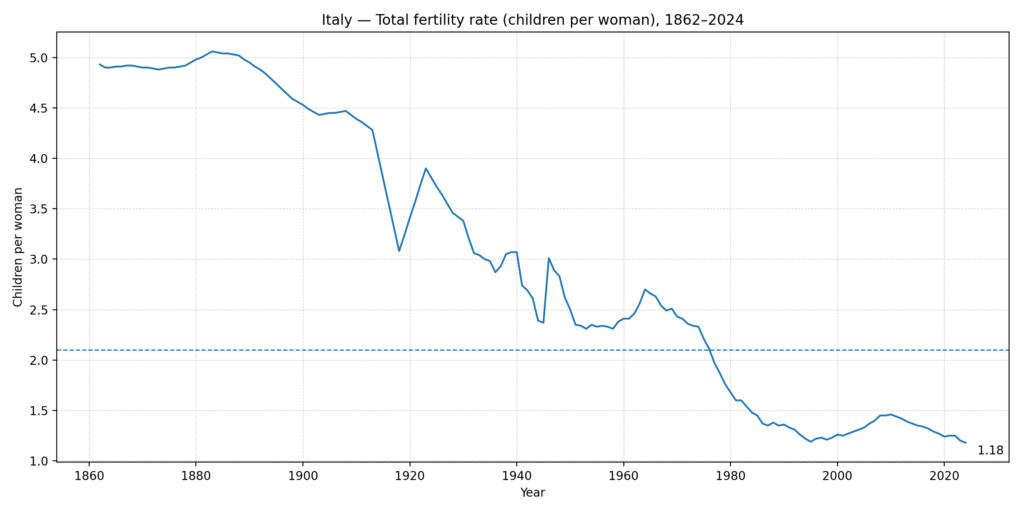

Italy’s birth rate has been below replacement level since 1976. In 2023, Italy recorded just 379,000 births – the lowest number since the country was unified in 1861. Meanwhile, deaths exceeded 700,000. The population is shrinking by over 300,000 people every single year.

And here’s the kicker: the younger generation is abandoning rural areas in droves, moving to Milan, Rome, Florence, Bologna – or leaving Italy entirely for better job opportunities in Northern Europe or North America.

What’s left behind? Thousands of abandoned houses in dying villages across southern Italy, Sardinia, Sicily, Piedmont, and Liguria.

These aren’t charming vacation cottages. These are often crumbling stone buildings that have been empty for 20, 30, sometimes 50 years. No one’s paying property taxes on them. No one’s maintaining them. They’re liabilities – urban blight that drags down entire communities.

So the Italian government, along with individual municipalities desperate to survive, came up with a plan: give the houses away for practically nothing, require the new owner to renovate within a specific timeframe, and hopefully breathe new life into these ghost towns.

It’s not charity. It’s survival.

Think of it like this: imagine you own a restaurant, but nobody’s coming in anymore. Your building is falling apart, you’re losing money every month, and you can’t afford to demolish it. Suddenly, someone offers to take the restaurant off your hands for one euro – but you make them promise to renovate it and reopen it within three years. You’d take that deal in a heartbeat, wouldn’t you?

That’s exactly what’s happening in places like Sambuca di Sicilia, Mussomeli, Ollolai, and dozens of other Italian towns.

But, Just to be precise, population is not the only indicator you want to consider when analyzing a real estate market.

Why Italy’s Housing Market Can Still Grow Even as Population Declines

Italy’s population has been shrinking for decades due to one of the lowest birth rates in Europe. Yet demographics are only one part of the real estate story — and not necessarily the most important for future housing demand in key markets.

According to forecasts and market research from Scenari Immobiliari — an independent real estate research institute — Italy’s property market is expected to grow over the long term. Their annual outlooks and reports (e.g., OUTLOOK 2025 – Osservatorio Italia 3D) analyze residential, commercial and office markets across Italy and project continued activity in transactions, prices and investment flows.

Here’s the key nuance:

Population decline ≠ fewer housing needs.

What really drives demand for housing is the number of households — not the absolute number of people. In Italy:

- Families are getting smaller (more single adults and couples, fewer multi-generation households).

- Households now often form and dissolve multiple times over a person’s life due to separation, remarriage, mobility — creating more households per capita over time.

- Even with fewer total people, this dynamic can increase demand for dwellings.

This matters because:

- Housing demand depends largely on nuclear households (units needing a residence), not just total population count.

- Smaller household sizes and greater turnover can mean more homes are needed per person than in past decades.

- These patterns tend to be strongest in high-demand areas (global cities, economic hubs, and tourism-driven markets), while many small towns with declining populations struggle with vacant and unsellable housing.

The Economics of Depopulation

Let’s look at some hard numbers.

According to ISTAT and ANCI (Italy’s National Association of Municipalities), the situation is stark: from 1971 to 2015, nearly 2,000 small Italian towns lost more than 20% of their population. 115 municipalities saw an exodus exceeding 60%. And it’s getting worse: between 2014 and 2024, Italy’s ‘internal areas’ – over 4,000 municipalities representing half the country’s territory – lost 5% of their population, compared to just 1.4% in urban centers.

136 villages are now completely abandoned – not a single resident left. Another 46 villages have only 1 or 2 elderly residents.

Here’s a chart showing the population decline in key one-euro house municipalities:

[CHART 1: Population Decline in One-Euro House Towns, 2000-2024]

| Municipality | Region | Population 2000 | Population 2024 | % Decline |

|---|---|---|---|---|

| Sambuca di Sicilia | Sicily | 6,500 | 5,800 | -10.8% |

| Mussomeli | Sicily | 11,400 | 10,100 | -11.4% |

| Ollolai | Sardinia | 1,600 | 1,200 | -25.0% |

| Cinquefrondi | Calabria | 6,700 | 5,900 | -11.9% |

| Bisaccia | Campania | 4,200 | 3,600 | -14.3% |

Source: ISTAT (2024)

And here’s what nobody tells you: these towns aren’t just losing people. They’re losing services.

When the population drops below a certain threshold, schools close. Doctors leave. Banks shut down. Public transportation disappears. The nearest hospital might be an hour away on winding mountain roads.

So yes, you can buy a house for one euro. But you’re also buying into a community that’s in critical condition.

CHAPTER 2: The Real Cost of a 1€ House

It’s Not Free – It’s a Trap (Sort Of)

Here’s where the dream turns into a nightmare for most buyers.

When you buy a one-euro house, you’re not just buying a house. You’re signing a contract that typically requires you to:

- Renovate the property within 2-3 years (timeframes vary by municipality)

- Sometimes Deposit a security bond of €5,000-€10,000 (refundable only if you complete the renovation on time)

- Prove you have the financial means to complete the renovation (some towns require bank statements showing €50,000+ in available funds)

- Submit detailed renovation plans approved by the local building department

- Use licensed Italian contractors (no DIY unless you’re a licensed geometra or architect)

Miss any of these requirements? You lose your deposit and potentially face legal action.

Now let’s talk about the actual costs.

Renovation Costs: The Budget Reality Check

In Italy, renovation costs for historic buildings – which most one-euro houses are – run significantly higher than in the US or UK. Why?

- Strict preservation rules: If your house is in a historic center (centro storico), you can’t just knock down walls and install modern windows. Every change must be approved by the Soprintendenza (Italy’s cultural heritage authority). This adds months of delays and thousands in consulting fees.

- Labor costs: Italian contractors are expensive. Expect to pay €30-€50 per hour for skilled laborers, €80-€150 per hour for specialized craftsmen (stonemasons, restoration experts).

- Materials: Historic buildings require specific materials – traditional lime plaster, terracotta roof tiles, chestnut wood beams. You can’t just go to Home Depot.

- Infrastructure: Many one-euro houses lack basic services. No plumbing. No electricity. No gas lines. You’re essentially building from scratch inside a shell.

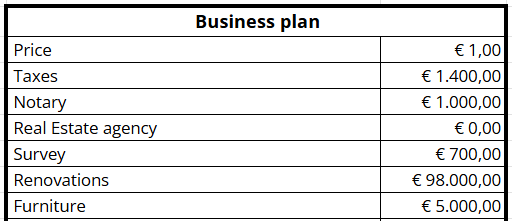

Here’s a real-world example from a 1€ house I tried to buy last year:

Case Study

So I could end up pay more then 100.000 €.

You could think that is still a good deal, but you are buyng in a dying town where the real estate market is so desperate they have to sell for 1€.

Do you think that the property could be valued at least what I should invest there?

Hidden Costs Nobody Mentions

Beyond the obvious renovation costs, here are the expenses that blindside most foreign buyers:

1. Travel costs

You can’t manage a renovation from Seattle or London. You need to be on-site regularly, or hire a project manager (add €5,000-€15,000 to your budget). Flights, accommodation, meals – it adds up fast.

2. Language barriers

Unless you speak fluent Italian, you’ll need translators or an agent that speaks english for contracts, permits, and contractor negotiations. Many towns involved in one-euro programs don’t have English-speaking staff.

3. Property taxes during renovation

Even though the house is uninhabitable, you still owe IMU (Italy’s property tax) during the renovation period. For a 120 sqm house in a small town, expect €300-€800 per year.

4. Utility setup fees

Connecting water, gas, and electricity isn’t free. Initial hookup fees can run €1,500-€3,000 total.

5. Surveyor (geometra) fees

In Italy, you need a licensed geometra to verify that your renovation complies with building codes and cadastral records. Budget €2,000-€5,000 depending on complexity.

6. Insurance

During renovation, you need builder’s risk insurance. After completion, home insurance. In remote areas with aging infrastructure, premiums are higher than urban centers.

7. Condominium fees

If your one-euro house is attached to other buildings (common in historic centers), you may owe condominium fees for shared walls, roofs, or common areas. This can be a nasty surprise, but it is rare that a 1 € house is part of a working condominium.

Wait – you might be thinking: “I’ve seen Instagram influencers who renovated their one-euro houses for €30,000! You’re exaggerating!”

No, I’m not.

Those viral renovation stories? They’re either:

- Counting only materials, not labor (because they did most work themselves – which is technically illegal in some cases in Italy without proper licenses)

- Cherry-picking the cheapest possible finishes (no insulation, minimal plumbing, DIY electrical work that won’t pass inspection)

- Conveniently leaving out professional fees, permits, and compliance costs

CHAPTER 3: The Legal and Bureaucratic Nightmare

Contracts and Penalties

When you buy a one-euro house, you’re signing a preliminary contract (compromesso) with very specific obligations. This isn’t like buying a normal property where you have flexibility.

Typical contract terms include:

- Renovation deadline: Usually 24-36 months from the date of purchase

- Security deposit: €5,000-€10,000, held in escrow

- Minimum investment: Many towns require you to spend at least €20,000-€50,000 on renovations (you must provide receipts)

- Residency requirement: Some municipalities require you to establish residency within 12 months

- No resale for X years: Often you cannot sell the property for 5-10 years after purchase

If you fail to meet these terms, the town can:

- Forfeit your security deposit

- Force you to pay penalty fees

- Nullify the sale and reclaim the property

And here’s the kicker: Italian contract law heavily favors the seller (in this case, the municipality). Good luck fighting a lawsuit in Italian courts as a foreigner.

Compliance Issues: The Italian Nightmare

Remember how I said these houses are abandoned?

That usually means they’re not compliant with current building codes, cadastral records, or urban planning regulations.

In Italy, this is called difformità urbanistica – basically, something was built or modified without proper permits. Maybe a previous owner added a bathroom without permission. Or enclosed a balcony. Or converted an attic into living space.

Fixing these compliance issues can cost tens of thousands of euros and take months or years of bureaucratic back-and-forth with the local building department.

In the US or UK, you might just tear down the illegal addition and move on. In Italy? Not so simple. You need:

- A geometra to survey the property and identify all discrepancies

- An architect to draw up plans for “sanazione” (regularization)

- Building permits from the municipality

- Approval from Soprintendenza (if it’s a historic building)

- Updated cadastral records at the Agenzia delle Entrate

This process – called condono edilizio (building amnesty) – can cost €10,000-€30,000 and take 12-24 months.

And if the discrepancy is too severe? You might not be able to fix it at all. The property could be deemed abusiva (illegal) and you’d be forced to demolish the non-compliant portions.

Imagine spending €50,000 on renovations only to be told by the town that you need to tear down half the house because a wall was added in 1987 without a permit.

It happens.

Notary and Legal Costs

Unlike in the US where you choose a title company, in Italy you’re required to use a notaio (notary) for the deed. The notary represents the Italian State, not you – their job is to ensure the transaction is legal and taxes are paid, not to protect your interests.

Notary fees for a one-euro house are typically €1,500-€3,000 (yes, more than the purchase price).

You’ll also want:

- A surveyor (geometra) for due diligence: €1,500-€3,000

- A translator if you don’t speak Italian: €50-€100/hour for legal documents

Total legal/administrative costs before you even start renovating: €5,000-€11,000.

CHAPTER 4: Location, Location, Location (Or Lack Thereof)

Where These Houses Actually Are

Let’s be brutally honest: most one-euro houses are in places you’ve never heard of. And there’s a reason for that.

These aren’t properties in Florence, Rome, or the Amalfi Coast. They’re in remote villages in:

- Inland Sicily (Sambuca, Mussomeli, Cammarata)

- Sardinia (Ollolai, Nulvi)

- Calabria (Cinquefrondi, Bova)

- Molise (Castropignano, Casalciprano)

- Piedmont (Borgomezzavalle, Carrega Ligure)

Some of these towns are 2-3 hours from the nearest airport. The nearest supermarket might be 30 minutes away by car (and you will need a car – public transport is nonexistent). The nearest hospital? An hour.

In the US, this would be like buying a house in rural West Virginia or the Upper Peninsula of Michigan. Beautiful, sure. Practical for most people? No.

It is still good for you if you want to live in beatiful countriside or mountain and you are not interested to be near to services or to re-sell the property in the future.

What It’s Like to Actually Live There

Let me paint you a picture:

You’ve just bought your dream one-euro house in a hilltop town in Calabria (this is where I wanted to buy that). You imagine lazy mornings drinking espresso in the piazza, chatting with friendly locals, buying fresh mozzarella at the corner shop.

Here’s reality:

- The piazza has three people in it, all over 75 years old

- The coffee bar is only open Tuesday-Saturday, 7am-12pm

- There is no corner shop – the nearest grocery store is 20km away

- Most locals speak only dialect, not standard Italian, and certainly not English

- Internet? Forget high-speed fiber. You’ll be lucky to get 5 Mbps DSL.

Now, for some people – retirees, digital nomads who travel often, artists looking for isolation – this might be perfect.

But for most foreign buyers who imagine splitting time between their Italian village and their home country? The reality is: after 2-3 weeks, you get bored. And then your one-euro house sits empty 10 months of the year while you keep paying IMU, utilities, and maintenance.

Investment Potential: Zero

Let’s address the elephant in the room: Can you make money with a one-euro house?

Short answer: No.

Long answer: Hell no.

Here’s why:

1. No resale market

Who’s going to buy your renovated house in a dying village in inland Sicily? Locals are leaving, not moving in. Other foreigners willing to take on a one-euro project would rather buy their own for… one euro.

The few renovated one-euro houses that do sell tend to go for €40,000-€80,000 max – far below the €100,000-€150,000 most buyers invest in total (purchase + renovation + fees).

2. No rental demand

Think you can Airbnb it? Good luck. Tourism in these areas is minimal. The few tourists who do visit are usually Italians from nearby cities looking for a weekend escape – and they’re not paying premium rates.

According to AirDNA (vacation rental analytics), average daily rates in Mussomeli, Sicily: €45-€65. Occupancy: 20-35% annually. That’s maybe €4,000-€7,000 in gross annual revenue.

After expenses (utilities, cleaning, maintenance, platform fees, taxes), you’re netting €2,000-€3,000 per year. It would take 50-60 years to recoup your investment.

In Florence? Average ADR is €180, occupancy 65-75%, netting €20,000-€30,000 annually. But you can’t buy in Florence for one euro.

3. No appreciation

Real estate appreciates when demand exceeds supply. In one-euro house towns, demand is zero. Supply is infinite (thousands of abandoned houses).

Italian property values are determined by: Population growth + Economic activity + Infrastructure. All three are negative in these areas.

[CHART 3: Comparison of Investment Returns – One-Euro House vs. Traditional Purchase]

| Metric | One-Euro House (Mussomeli) | Renovated Apartment (Palermo) |

|---|---|---|

| Total Investment | €130,000 | €150,000 |

| Annual Rental Income | €3,000 | €12,000 |

| Net Yield | 2.3% | 8.0% |

| 10-Year Appreciation | 0% | +15-25% |

| Liquidity | Very Low | Moderate |

| Management Difficulty | High | Low |

Source: Valente Italian Properties analysis + AirDNA (2024)

From an investment perspective, a one-euro house is a black hole. You throw money in, nothing comes back out.

You know what’s crazy? Despite everything I just told you, applications for one-euro houses are at an all-time high.

Why? Because humans are irrational. We see a headline that says “free house in Italy” and our brains shut off. We don’t think about the costs, the logistics, the isolation. We think about the fantasy.

But here’s the thing: real estate isn’t about fantasy. It’s about math.

And the math on one-euro houses doesn’t work for 95% of buyers.

CHAPTER 5: Who Should Actually Buy a One-Euro House?

The 5% for Whom This Makes Sense

I don’t want to be completely negative. There are specific people for whom a one-euro house could work:

1. Retirees with time and money

If you’re retired, have €100,000-€150,000 saved specifically for this project, don’t need to worry about ROI, and genuinely want to live in rural Italy full-time – go for it.

But be honest with yourself: Are you really going to live in a village of 1,200 people where nobody speaks English and the nearest hospital is more than an hour away? At 70 years old?

2. Remote workers with no ties

You work 100% remotely, you’re single or your partner is equally adventurous, you don’t mind isolation, and you see this as a 2-3 year life experiment. Maybe it works.

But remember: Italian internet in rural areas is terrible.

3. Artists/writers looking for inspiration

If you’re a painter, writer, or musician who craves solitude and doesn’t care about modern amenities, a one-euro house could be your creative retreat.

Just know: You’re not making an investment. You’re making a lifestyle choice.

4. Italians with family roots

If your grandparents were from Mussomeli and you have a deep personal connection to the area, buying a one-euro house can be a way to reconnect with your heritage.

Emotional value ≠ financial value, but it’s still value.

5. Developers with €500K+ budgets

If you’re a developer planning to buy multiple one-euro houses, combine them into a boutique hotel or agriturismo, and you have serious capital and local connections – there’s potential because you improve an entire location and spend money in marketing.

High risk but (maybe) high ROI.

Who Should Absolutely NOT Buy a One-Euro House

1. Anyone looking to build wealth through real estate

If your goal is to grow your net worth or create passive income, a one-euro house is the wrong move. Period.

Buy in Milan, Bologna, Florence, or Rome where there’s actual demand from buyers and tenants.

2. Vacation home buyers who visit 2-4 weeks per year

If you’re only going to use the house a few weeks annually, you’re far better off renting an Airbnb. €3,000-€5,000 per year in rentals vs. €100,000+ to buy and renovate a house you barely use? The math is obvious.

Plus, renting gives you flexibility. You can visit different regions of Italy each year instead of being tied to one dying village.

3. Foreigners with no Italian language skills or local connections

The bureaucracy will eat you alive. You’ll be taken advantage of by contractors. You’ll miss critical deadlines. You’ll end up stressed, broke, and possibly in legal trouble.

4. Anyone without at least €100,000 liquid

If you can’t write a check for €100,000 tomorrow without impacting your retirement, emergency fund, or other financial goals – do not buy a one-euro house.

The costs will spiral. And when they do, you need cash reserves to handle it.

5. People expecting to flip for profit

This isn’t HGTV. You’re not going to renovate and sell for 3x your investment. The resale market doesn’t exist.

CHAPTER 6: What Foreign Buyers Should Do Instead

Better Alternatives for International Buyers

If you genuinely want to own property in Italy, here are smarter options:

1. Buy a move-in-ready apartment in a thriving city

For €150,000-€250,000, you can buy a renovated 2-bedroom apartment in:

- Bologna (historic center or university district)

- Turin (San Salvario, Crocetta)

- Palermo (near Teatro Massimo)

- Bari (old town, near the port)

These cities have:

- Growing populations (especially Bologna and Bari)

- Strong rental demand (students, young professionals, tourists)

- Good infrastructure (airports, trains, hospitals)

- International communities (easier integration)

[CHART 4: Rental Yields – Major Italian Cities vs. One-Euro Towns]

| Location | Avg. Price/sqm | Gross Rental Yield | Population Trend |

|---|---|---|---|

| Bologna | €3,200 | 4.5-5.5% | Growing (+0.5% YoY) |

| Turin | €2,400 | 4.8-6.0% | Stable |

| Palermo | €1,800 | 5.5-7.0% | Stable |

| Bari | €2,100 | 5.0-6.5% | Growing (+0.8% YoY) |

| Mussomeli | €400 | 2.0-3.0% | Declining (-1.2% YoY) |

Source: Idealista, Tecnocasa, ISTAT (2024)

2. Buy in tourist-friendly areas with actual vacation rental potential

If you want a vacation home that generates income when you’re not using it:

- Tuscan countryside near Siena, Lucca, or Montepulciano

- Lake Como, Lake Garda

- Umbria (Perugia, Assisi)

- Coastal Puglia (Ostuni, Polignano a Mare)

Yes, these properties cost €200,000-€500,000+, but they’re actually worth something. And they can generate €15,000-€40,000 annually in rental income.

3. Just rent

Seriously. If you love Italy and want to spend time there, rent different properties in different regions. Experience Tuscany, Sicily, Puglia, Veneto. Figure out where you actually want to be.

Then – if you still want to buy – make an informed decision.

Renting 4 weeks per year costs €4,000-€8,000 depending on season and location. Over 20 years, that’s €80,000-€160,000. Still cheaper than a one-euro house renovation, with zero headache and full flexibility.

CHAPTER 7: The Bigger Picture – Italy’s Real Estate Reality

Why Italy’s Housing Market Is Broken

The one-euro house phenomenon is a symptom of a much larger problem: Italy’s demographics are in crisis.

What’s left? An aging population concentrated in a few cities (Rome, Milan, Naples, Turin, Bologna, Florence) while rural areas empty out.

According to Banca d’Italia (Bank of Italy), there are now over 7 million vacant residential units in Italy – 20% of the total housing stock. and Guess where these empty houses are? Exactly, in 1€ house’s towns.

7 million empty homes. In a country of 59 million people.

So, you have 2 velocity real estate markets in Italy:

- Growing regions and cities (Which I mentioned)

- Declining regions and towns

So, it is vital you choose the right location to buy.

Final Verdict – Should You Buy a One-Euro House?

The Brutal Truth

Buy a one-euro house if:

- ✅ You have €100,000-€150,000 you’re willing to lose (not invest – lose)

- ✅ You genuinely want to live in rural Italy full-time for at least 5 years

- ✅ You speak Italian or have a local partner who does

- ✅ You have extensive renovation experience or can hire a full-time project manager

- ✅ You understand this is a lifestyle choice, not an investment

- ✅ You’re okay with zero resale value and minimal rental income

- ✅ You’re retired or work 100% remotely with no geographic constraints

Do NOT buy a one-euro house if:

- ❌ You’re looking to build wealth or generate passive income

- ❌ You only plan to visit 2-4 weeks per year

- ❌ You don’t speak Italian

- ❌ You have less than €100,000 in liquid savings

- ❌ You expect to resell at a profit

- ❌ You’re attracted by the “one euro” gimmick without understanding the full costs

- ❌ You need good internet, healthcare, or proximity to international airports

What I Recommend for International Buyers

Here’s what I tell every foreign client who asks about one-euro houses:

Don’t chase gimmicks. Chase value.

If you have €100,000 to invest in Italian real estate:

Option A: Buy a one-euro house, spend €100,000 renovating it, end up with a property in a dying village that you can’t sell and can barely rent.

Option B: Buy a renovated 2-bedroom apartment in Bologna’s university district for €150,000. Rent it to students for €1,000/month (€12,000/year gross). Net 6-7% annually. Watch it appreciate 2-3% per year. Sell in 10 years for €200,000+.

Which makes more sense?

Look, I get it. The fantasy of owning a crumbling stone villa in Sicily is seductive. I’m Italian – I feel that pull too.

But real estate is about math, not romance. And the math on one-euro houses is terrible.

If you want to experience rural Italy, rent a farmhouse for a month every summer. If you want to invest in Italian real estate, buy in cities and regions with actual economies.